A Ticking Bomb – is there a leader who can diffuse it? Al Gore?

September 30, 2007

I returned at the end of last week from the Imperial fall maneuvers, held this year in Ostland. His Majesty’s forces prevailed, for much the same reasons that Blue usually wins in American war games. As someone who has led Red to victory in several senior-level games conducted in Washington, I can assure you that isn’t supposed to happen.

I don’t think it possible for any historian to visit the Baltic countries or the rest of Central Europe and not reflect on the catastrophes World War I brought for that part of the world. Communism, World War II, National Socialism, the extinction of some communities and the expulsion of others, wholesale alteration of national boundaries, all these and more flowed from the assassination of the Archduke Franz Ferdinand on June 28, 1914. One pebble touched off an avalanche.

It did so because it occurred, not as an isolated incident, but as one more in a series of crises that rocked Europe in its last ten years of peace, 1904–1914. Each of those crises had the potential to touch off a general European war, and each further de-stabilized the region, making the next incident all the more dangerous. 1905–06 witnessed the First Moroccan Crisis, when the German Foreign Office (whose motto, after Bismarck, might well be, “Clowns unto ages of ages”) compelled a very reluctant Kaiser Wilhelm II to land at Tangier as a challenge to France. 1908 brought the Bosnian Annexation Crisis, where Austria humiliated Russia and left her anxious for revenge. Then came the Second Moroccan Crisis of 1911, the Tripolitan War of 1911–1912 (a war Italy actually won, against the tottering Ottoman Empire) and the Balkan Wars of 1912–13. By 1914, it had become a question more of which crisis would finally set all Europe ablaze than of whether peace would endure. This was true despite the fact that, in the abstract, no major European state wanted war.

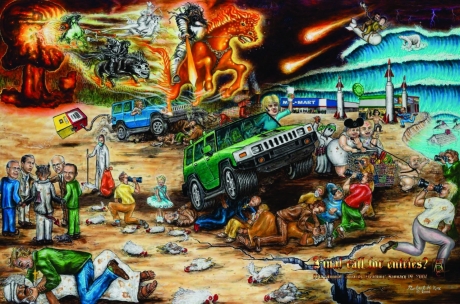

If this downward spiral of events in Europe reminds us of the Middle East today, it should. There too we see a series of crises, each holding the potential of kicking off a much larger war. There are almost too many to list: the war in Iraq, the U.S versus Iran, Israel vs. Syria, the U.S. vs. Syria, Syria vs. Lebanon, Turkey vs. Kurdistan, the war in Afghanistan, the de-stabilization of Pakistan, Hamas, Hezbollah, al Qaeda, and the permanent crisis of Israel vs. the Palestinians. Each is a tick of the bomb, bringing us closer and closer to the explosion no one wants, no one outside the neo-con cabal and Likud, anyway.

A basic rule of history is that the inevitable eventually happens. If you keep on smoking in the powder magazine, you will at some point blow it up. No one can predict the specific event or its timing, but everyone can see the trend and where it is leading.

In the Middle East today, as in Europe in the decade before World War I, the desperate need is for a country or a leader to reverse the trend. Then, the two European leaders most opposed to war, Kaiser Wilhelm II of Germany and Tsar Nicholas II of Russia, were able to do little more than drag their feet, trying to slow the train of events down. That was not enough, and it will not be enough today in the Middle East either.

Where do we see a leader who can turn aside the march toward war? Not in the Middle East itself, nor among American Presidential candidates, only two of whom, Ron Paul and Dennis Kucinich, represent a real change of direction. Not in Europe, whose heads of government are terrified of breaking with the Americans. Not in Moscow or Beijing, both of which are happy to see America digging its own grave. No matter where we look, the horizon is empty.

Where do we see a leader who can turn aside the march toward war? Not in the Middle East itself, nor among American Presidential candidates, only two of whom, Ron Paul and Dennis Kucinich, represent a real change of direction. Not in Europe, whose heads of government are terrified of breaking with the Americans. Not in Moscow or Beijing, both of which are happy to see America digging its own grave. No matter where we look, the horizon is empty.

Where vision is wanting, the people perish. As they did in Central Europe in the 20th century, by the tens of millions.

September 29, 2007

William Lind is an analyst based in Washington, DC.

Copyright © 2007 William S. Lind

Anthrax Missing From Army Lab

September 21, 2007

January 20, 2002

By JACK DOLAN And DAVE ALTIMARI, Courant Staff Writers

Lab specimens of anthrax spores, Ebola virus and other pathogens disappeared from the Army’s biological warfare research facility in the early 1990s, during a turbulent period of labor complaints and recriminations among rival scientists there, documents from an internal Army inquiry show.

The 1992 inquiry also found evidence that someone was secretly entering a lab late at night to conduct unauthorized research, apparently involving anthrax. A numerical counter on a piece of lab equipment had been rolled back to hide work done by the mystery researcher, who left the misspelled label “antrax” in the machine’s electronic memory, according to the documents obtained by The Courant.

Experts disagree on whether the lost specimens pose a danger. An Army spokesperson said they do not because they would have been effectively killed by chemicals in preparation for microscopic study. A prominent molecular biologist said, however, that resilient anthrax spores could possibly be retrieved from a treated specimen.

In addition, a scientist who once worked at the Army facility said that because of poor inventory controls, it is possible some of the specimens disappeared while still viable, before being treated.

Not in dispute is what the incidents say about disorganization and lack of security in some quarters of the U.S. Army Medical Research Institute of Infectious Diseases – known as USAMRIID – at Fort Detrick, Md., in the 1990s. Fort Detrick is believed to be the original source of the Ames strain of anthrax used in the mail attacks last fall, and investigators have questioned people there and at a handful of other government labs and contractors.

It is unclear whether Ames was among the strains of anthrax in the 27 sets of specimens reported missing at Fort Detrick after an inventory in 1992. The Army spokesperson, Caree Vander-Linden, said that at least some of the lost anthrax was not Ames. But a former lab technician who worked with some of the anthrax that was later reported missing said all he ever handled was the Ames strain.

Meanwhile, one of the 27 sets of specimens has been found and is still in the lab; an Army spokesperson said it may have been in use when the inventory was taken. The fate of the rest, some containing samples no larger than a pencil point, remains unclear. In addition to anthrax and Ebola, the specimens included hanta virus, simian AIDS virus and two that were labeled “unknown” – an Army euphemism for classified research whose subject was secret.

A former commander of the lab said in an interview he did not believe any of the missing specimens were ever found. Vander-Linden said last week that in addition to the one complete specimen set, some samples from several others were later located, but she could not provide a fuller accounting because of incomplete records regarding the disposal of specimens.

“In January of 2002, it’s hard to say how many of those were missing in February of 1991,” said Vander-Linden, adding that it’s likely some were simply thrown out with the trash.

Discoveries of lost specimens and unauthorized research coincided with an Army inquiry into allegations of “improper conduct” at Fort Detrick’s experimental pathology branch in 1992. The inquiry did not substantiate the specific charges of mismanagement by a handful of officers.

But a review of hundreds of pages of interview transcripts, signed statements and internal memos related to the inquiry portrays a climate charged with bitter personal rivalries over credit for research, as well as allegations of sexual and ethnic harassment. The recriminations and unhappiness ultimately became a factor in the departures of at least five frustrated Fort Detrick scientists.

In interviews with The Courant last month, two of the former scientists said that as recently as 1997, when they left, controls at Fort Detrick were so lax it wouldn’t have been hard for someone with security clearance for its handful of labs to smuggle out biological specimens.

Lost Samples

The 27 specimens were reported missing in February 1992, after a new officer, Lt. Col. Michael Langford, took command of what was viewed by Fort Detrick brass as a dysfunctional pathology lab. Langford, who no longer works at Fort Detrick, said he ordered an inventory after he recognized there was “little or no organization” and “little or no accountability” in the lab.

“I knew we had to basically tighten up what I thought was a very lax and unorganized system,” he said in an interview last week.

A factor in Langford’s decision to order an inventory was his suspicion – never proven – that someone in the lab had been tampering with records of specimens to conceal unauthorized research. As he explained later to Army investigators, he asked a lab technician, Charles Brown, to “make a list of everything that was missing.”

“It turned out that there was quite a bit of stuff that was unaccounted for, which only verifies that there needs to be some kind of accountability down there,” Langford told investigators, according to a transcript of his April 1992 interview.

Brown – whose inventory was limited to specimens logged into the lab during the 1991 calendar year – detailed his findings in a two-page memo to Langford, in which he lamented the loss of the items “due to their immediate and future value to the pathology division and USAMRIID.”

Many of the specimens were tiny samples of tissue taken from the dead bodies of lab animals infected with deadly diseases during vaccine research. Standard procedure for the pathology lab would be to soak the samples in a formaldehyde-like fixative and embed them in a hard resin or paraffin, in preparation for study under an electron microscope.

Some samples, particularly viruses, are also irradiated with gamma rays before they are handled by the pathology lab.

Whether all of the lost samples went through this treatment process is unclear. Vander-Linden said the samples had to have been rendered inert if they were being worked on in the pathology lab.

But Dr. Ayaad Assaad, a former Fort Detrick scientist who had extensive dealings with the lab, said that because some samples were received at the lab while still alive – with the expectation they would be treated before being worked on – it is possible some became missing before treatment. A phony “log slip” could then have been entered into the lab computer, making it appear they had been processed and logged.

In fact, Army investigators appear to have wondered if some of the anthrax specimens reported missing had ever really been logged in. When an investigator produced a log slip and asked Langford if “these exist or [are they] just made up on a data entry form,” Langford replied that he didn’t know.

Assuming a specimen was chemically treated and embedded for microscopic study, Vander-Linden and several scientists interviewed said it would be impossible to recover a viable pathogen from them. Brown, who did the inventory for Langford and has since left Fort Detrick, said in an interview that the specimens he worked on in the lab “were completely inert.”

“You could spread them on a sandwich,” he said.

But Dr. Barbara Hatch Rosenberg, a molecular biologist at the State University of New York who is investigating the recent anthrax attacks for the Federation of American Scientists, said she would not rule out the possibility that anthrax in spore form could survive the chemical-fixative process.

“You’d have to grind it up and hope that some of the spores survived,” Rosenberg said. “It would be a mess.

“It seems to me that it would be an unnecessarily difficult task. Anybody who had access to those labs could probably get something more useful.”

Rosenberg’s analysis of the anthrax attacks, which has been widely reported, concludes that the culprit is probably a government insider, possibly someone from Fort Detrick. The Army facility manufactured anthrax before biological weapons were banned in 1969, and it has experimented with the Ames strain for defensive research since the early 1980s.

Vander-Linden said that one of the two sets of anthrax specimens listed as missing at Fort Detrick was the Vollum strain, which was used in the early days of the U.S. biological weapons program. It was not clear what the type of anthrax in the other missing specimen was.

Eric Oldenberg, a soldier and pathology lab technician who left Fort Detrick and is now a police detective in Phoenix, said in an interview that Ames was the only anthrax strain he worked with in the lab.

Late-Night Research

More troubling to Langford than the missing specimens was what investigators called “surreptitious” work being done in the pathology lab late at night and on weekends.

Dr. Mary Beth Downs told investigators that she had come to work several times in January and February of 1992 to find that someone had been in the lab at odd hours, clumsily using the sophisticated electron microscope to conduct some kind of off-the-books research.

After one weekend in February, Downs discovered that someone had been in the lab using the microscope to take photos of slides, and apparently had forgotten to reset a feature on the microscope that imprints each photo with a label. After taking a few pictures of her own slides that morning, Downs was surprised to see “Antrax 005” emblazoned on her negatives.

Downs also noted that an automatic counter on the camera, like an odometer on a car, had been rolled back to hide the fact that pictures had been taken over the weekend. She wrote of her findings in a memo to Langford, noting that whoever was using the microscope was “either in a big hurry or didn’t know what they were doing.”

It is unclear if the Army ever got to the bottom of the incident, and some lab insiders believed concerns about it were overblown. Brown said many Army officers did not understand the scientific process, which he said doesn’t always follow a 9-to-5 schedule.

“People all over the base knew that they could come in at anytime and get on the microscope,” Brown said. “If you had security clearance, the guard isn’t going to ask you if you are qualified to use the equipment. I’m sure people used it often without our knowledge.”

Documents from the inquiry show that one unauthorized person who was observed entering the lab building at night was Langford’s predecessor, Lt. Col. Philip Zack, who at the time no longer worked at Fort Detrick. A surveillance camera recorded Zack being let in at 8:40 p.m. on Jan. 23, 1992, apparently by Dr. Marian Rippy, a lab pathologist and close friend of Zack’s, according to a report filed by a security guard.

Zack could not be reached for comment. In an interview this week, Rippy said that she doesn’t remember letting Zack in, but that he occasionally stopped by after he was transferred off the base.

“After he left, he had no [authorized] access to the building. Other people let him in,” she said. “He knew a lot of people there and he was still part of the military. I can tell you, there was no suspicious stuff going on there with specimens.”

Zack left Fort Detrick in December 1991, after a controversy over allegations of unprofessional behavior by Zack, Rippy, Brown and others who worked in the pathology division. They had formed a clique that was accused of harassing the Egyptian-born Assaad, who later sued the Army, claiming discrimination.

Assaad said he had believed the harassment was behind him until last October, until after the Sept. 11 terrorist attacks.

He said that is when the FBI contacted him, saying someone had mailed an anonymous letter – a few days before the existence of anthrax-laced mail became known – naming Assaad as a potential bioterrorist. FBI agents decided the note was a hoax after interviewing Assaad.

But Assaad said he believes the note’s timing makes the author a suspect in the anthrax attacks, and he is convinced that details of his work contained in the letter mean the author must be a former Fort Detrick colleague.

Brown said that he doesn’t know who sent the letter, but that Assaad’s nationality and expertise in biological agents made him an obvious subject of concern after Sept. 11.

News Story identifying Dr. Philip Zack as the man caught entering the Anthrax storage area at Fort Detrick without authorization. In this story, it is reported that Dr. Zack was caught on a security tape making an unauthorized entry into the Anthrax storage area.

Foreign press picks up story that Anthrax letters were sent by American bio-war scientist … and that the FBI is dragging its feet on the case.

FBI’S PRIME SUSPECT ON ANTHRAX LETTERS IS JEWISH! No wonder they were dragging their feet.

Salon’s story of the attempt to frame Dr. Ayaad Assaad, an Egyptian, for the Anthrax letters

Anthrax and the Agency

September 21, 2007

April 8, 2002

Anthrax and the Agency

Thinking the Unthinkable

By Wayne Madsen

Now that the Federal Bureau of Investigation (FBI) has officially put the anthrax investigation on a back burner, it is time for Americans to think the unthinkable: that the FBI has never been keen to identify the perpetrator because that perpetrator may, in fact, be the U.S. Government itself. Evidence is mounting that the source of the anthrax was a top secret U.S. Army laboratory in Maryland and that the perpetrators involve high-level officials in the U.S. military and intelligence infrastructure.

FBI Debunks Anthrax-Hijacker Link

Coming shortly after the hijacked airliner attacks on New York and Washington, the anthrax attacks on the U.S. Congress, major media outlets, and the U.S. Postal System were, at first, blamed by the Bush administration on Al Qaeda or Iraq. However, on March 23, the FBI officially announced that “exhaustive testing did not support that anthrax was present anywhere the hijackers had been.” This statement came after a rather weak story based on conjecture appeared in The New York Times. The article reported that a Fort Lauderdale emergency room doctor treated Saudi hijacker Ahmed Alhanzawi in June 2001 for a cutaneous anthrax lesion on his leg. Although the doctor, Christos Tsonas, did not think the lesion was caused by anthrax at the time he cleansed and treated the wound, he later changed his mind after realizing Alhanzawi was one of the hijackers.

Although Tsonas’ theory was rejected by the FBI, it was supported by Johns Hopkins University’s Center for Biodefense Strategies. Johns Hopkins has its own peculiar link to anthrax. President Bush recently named as the Director of the National Institutes of Health (NIH), Dr. Elias Zerhouni, an Algerian-born professor at Johns Hopkins University and notorious Pentagon yes-man on anthrax bio-defenses. As a member of the National Academy of Sciences’ Institute of Medicine, Zerhouni and his colleagues, serving on a National Academy of Sciences Institute of Medicine special committee, gave a green light to the Pentagon’s use of a questionable anthrax vaccine on military personnel. According to Dr. Meryl Nass, a member of the Federation of American Scientists who spent three years studying the world’s largest recorded anthrax epidemic in Zimbabwe from 1979 to 1980, the report generated by Zerhouni and his colleagues “relies on ignoring many pieces of crucial information, and its recommendations give the Department of Defense everything it could have wanted. The report appears to be ‘spun’ to support a number of DOD initiatives, and it provides the needed justification for restarting mandatory anthrax vaccinations over the objections of many in Congress.”

U.S. Link to Anthrax No Conspiracy Theory

Forget unfounded conspiracy theories. The evidence is overwhelming that the FBI has consistently shied away from pursuing the anthrax investigation, in much the same way it avoided pursuing leads in the USS Cole, East Africa U.S. embassies, and Khobar Towers bombings.

On April 4, ABC News investigative reporter Brian Ross broadcast on ABC World News Tonight that after six months the FBI still had hardly any clues and no suspects in its anthrax investigation. A Soviet defector, the former First Deputy Director of Biopreparat from 1988 to 1992 and anthrax expert, Ken Alibek (formerly Kanatjan Alibekov), now a U.S. government consultant, made the astounding claim that the person who is behind the anthrax attacks may, in fact, been advising the U.S. government. After having passed a lie detector test, Alibek was cleared of any suspicion.

Interestingly, Alibek is President of Hadron Advanced Biosystems. On October 2, 2001, just two days before the first anthrax case was reported in Boca Raton, Florida and a week and a half before the first anthrax was sent through the mail to NBC News in New York, Advanced Biosystems received an $800,000 grant from NIH to focus on very specific defenses against anthrax. Hadron has long been linked with the CIA. The links include charges by many former government officials, including the late former Attorney General Elliot Richardson, that the company’s former President, Earl Brian, illegally procured a database system called PROMIS (Prosecutors’ Management Information System) from Inslaw, Inc. and used his connections to the CIA and Israeli intelligence to illegally distribute the software to various foreign governments.

Ross reported that U.S. military and intelligence agencies have refused to provide the FBI with a full listing of the secret facilities and employees working on anthrax projects. Because of this stonewalling, crucial evidence has been withheld. Professor Jeanne Guilleman of MIT’s Biological Weapons Studies Center told ABC, “We’re talking here about laboratories where, in fact, the material that we know was in the Daschle letter and in the Leahy letter could have been produced. And I think that’s what the FBI is still trying to find out.”

But the FBI does not seem to want to pursue these important leads.

CIA Testing Anthrax and the U.S. Mail

The first major media outlet to accuse the FBI of foot dragging was the BBC. On March 14, the BBC’s Newsnight program highlighted an interview with Dr. Barbara Rosenberg of the Federation of American Scientists. After claiming the CIA was involved, through government contractors, in secret testing of sending anthrax through the mail, Rosenberg, someone with close ties to the biological warfare community, has been attacked by the White House, FBI, and, not surprisingly, the CIA.

The BBC also interviewed Dr. Timothy Read of the Institute of Genomic Research and a leading expert on the genetic characteristics of anthrax. Read said of the two strains, “They’re definitely related to each other … closely related to each other.” However, Read would not go so far as to suggest the Florida strain, known as the Ames strain, and that developed at the U.S. Army’s top secret Fort Detrick biological warfare laboratory – officially known as the U.S. Army Medical Research Institute of Infectious Diseases — were one and the same.

William Capers Patrick III was part of the original Fort Detrick anthrax development program, which “officially” ended in 1972 when President Nixon signed, along with the Soviet Union and United Kingdom, the Biological Weapons Convention. Nixon had actually ordered the Pentagon to stop producing biological weapons in 1969. It now seems likely that the U.S. military and intelligence community failed to follow Nixon’s orders and, in fact, have consistently violated a lawful treaty signed by the United States.

Cuba certainly accused the United States of using biological war weapons against it during the 1970s. In his book, Biological Warfare in the 21st Century, Malcolm Dando refers to the U.S. bio-attacks against the Caribbean island nation. The American covert campaign targeted the tobacco crop using blue mold, the sugar cane crop using cane smut, livestock using African swine fever, and the Cuban population using a hemorrhagic strain of dengue fever.

Last December, the New York Times claimed Patrick authored a secret paper on the effects of sending anthrax through the mail, a report he denies. However, Patrick told the BBC that he was surprised that as an expert of anthrax (he was a member of the UN biological warfare inspection team in the 1990s), the FBI did not interview him right after the first anthrax attacks.

The BBC reported that Battelle Memorial Institute (a favorite Pentagon and CIA contractor and for whom Alibek served as biological warfare program manager in 1998) conducted a secret biological warfare test in the Nevada desert using genetically-modified anthrax early last September, right before the terrorist attacks. The BBC reported that Patrick’s paper on sending anthrax through the mail was also part of the classified contractor work on the deadly bacterial agent.

But would the U.S. Government knowingly subject its citizenry to a dangerous test of biological weapons? The evidence from past tests suggests it has already done so. According to Dando, in the 1950s, the military released uninfected female mosquitoes in a residential area of Savannah, Georgia. It then checked on how many entered houses and how many people were bitten. In 1956, 600,000 mosquitoes were released from an airplane on a bombing range. Within one day, the mosquitoes had traveled as far as two miles and had bitten a number of people. In 1957, at the Dugway Proving Grounds in Utah, the Q-Fever toxin discharged by an airborne F-100A plane. If a more potent dose had been used, the Army concluded 99 per cent of the humans in the area would have been infected. In the 1960s, conscientious objecting Seventh Day Adventists, serving in non-combat positions in the Army, were exposed to airborne tularemia. In addition to Dando’s revelations, a retired high-ranking U.S. Army civilian official reported that the Army used aerosol forms of influenza to infect the subway systems of New York, Chicago, and Philadelphia in the early 1960s.

From Fort Detrick With Love

The Hartford Courant reported last January that 27 sets of biological toxin specimens were reported missing from Fort Detrick after an inventory was conducted in 1992. The paper reported that among the specimens missing was the Ames strain on anthrax. A former Detrick laboratory technician named Eric Oldenberg told The Courant that while at Detrick, he only handled the Ames strain, the same strain sent to the Senate and the media. The Hartford Courant also revealed that other specimens missing included Ebola, hanta virus, simian AIDS, and two labeled “unknown,” a cover term for classified research on secret biological agents.

Steven Block of Stanford University, an expert on biological warfare, told The Dallas Morning News that, “The American process for preparing anthrax is secret in its details, but experts know that it produces an extremely pure powder. One gram (a mere 28th of an ounce) contains a trillion spores . . . A trillion spores per gram is basically solid spore . . . It appears from all reports so far that this was a powder made with the so-called optimal U.S. recipe . . . That means they either had to have information from the United States or maybe they were the United States.” (author’s emphasis).

Block also told the Dallas paper, “The FBI, after all these months, has still not arrested anybody . . . It’s possible, as has been suggested, that they may be standing back because the person that’s involved with it may have secret information that the United States government would not like to have divulged.”

And what the government would not want divulged is the fact that the United States has been in flagrant violation of the 1972 Biological Weapons Convention. Article 1 of the convention specifically states: “Each State Party to this Convention undertakes never in any circumstance to develop, produce, stockpile or otherwise acquire or retain: 1. Microbial or other biological agents, or toxins whatever their origin or method of production, of types and in quantities that have no justification for prophylactic, protective or other peaceful purposes. 2. Weapons, equipment or means of delivery designed to use such agents or toxins for hostile purposes or in armed conflict.”

The Death of Dr. Wiley: Murder They Wrote

The one person who was in a position to know about the origin of the anthrax sent through the U.S. Postal Service met with a very suspicious demise just a month after the attacks first began.

The reported “suicide” and then “accidental death” of noted Harvard biophysics scientist and anthrax, Ebola, AIDS, herpes, and influenza expert, Dr. Don C. Wiley, on the Interstate 55 Hernando De Soto Bridge that links Memphis to West Memphis, Arkansas, was probably a well-planned murder, according to local law enforcement officials in Tennessee and Arkansas.

On November 15, Wiley’s abandoned 2001 Mitsubishi Galant rental car was strangely found in the wrong lane, west in the eastbound lane of the bridge. The keys were still in the ignition, the gas tank was full, the hub cap of the right front wheel was missing, and there were yellow scrape marks on the driver’s side of the vehicle, indicating a possible sideswipe.

Wiley had last been seen four hours earlier, around midnight, before his car was found around 4:00 AM on the bridge. He was last seen in the lobby of Memphis’ Peabody Hotel, leaving a banquet of the St. Jude Children’s Research Hospital, on whose advisory board he served. Police quickly “concluded” that Wiley committed suicide by jumping off the bridge into the Mississippi River. It appears the early police conclusion, decided without a full investigation, was engineered by the FBI. On December 20, Wiley’s body was recovered in the river in Vidalia, Louisiana, 320 miles south of Memphis. After Wiley’s friends and family discounted claims of suicide, the Memphis coroner concluded on January 14, 2002 that Wiley had “accidentially” fallen over the side of the bridge after a minor car accident.

Not so, say seasoned local law enforcement officials who originally assigned homicide detectives to the case. Memphis police claim there was only 15 minutes between the last time police had checked the bridge and the time they discovered Wiley’s abandoned vehicle. They suspected Wiley was murdered. However, the local FBI office in Memphis stuck by its story that Wiley’s death was not the result of “foul play.” A Memphis police detective said, “the newspaper account of Wiley’s accident did not clear anything up for me,” adding, “everything attributed to the ‘accident’ could also be attributed to something else.”

However, according to U.S. intelligence sources, Wiley may have been the victim of an intelligence agency hit. That jibes with local police comments that the FBI and “other” U.S. agencies stepped in to prevent the local Memphis police from taking a closer look into the case. Employees of St. Jude’s Childrens’ Hospital in Memphis, on whose board Wiley served, were suddenly deluged with unsubstantiated rumors that Wiley was a heavy drinker and despondent.

It is a classic intelligence agency ploy to spread disinformation about “suicide” victims after their murders. The favorite rumors spread include those about purported alcoholism, depression, homosexuality, auto-erotic asphyxia, drug addiction, and an obsession with pornography, especially child pornography.

According to the local police, it would have been easy to determine if Wiley was a heavy drinker and that would have shown up in his autopsy. The police also reckon that if Wiley left the Peabody under the influence, four hours later he should have been sober enough not to have fallen over the side of the bridge. Also, the bridge railing is high enough that event the 6′ 3″ Wiley could not have accidentally fallen over it without assistance. Add that to the fact that no one in the history of the bridge had fallen over the side.

Police also feel that even at 4:00 AM, there should have been someone else on the bridge who would have called the police about a person who was driving down the interstate the wrong way. Due to the fact that access is restricted to the bridge, one would have to have driven a long way on the wrong lane. Some police are of the opinion Wiley was stuck with a needle and that one reason he was dumped into the fast-moving Mississippi is that with the length of his time in the water (one month), the needle mark evidence would have largely disappeared.

And in yet another strange twist, on March 14, a bomb and two smaller explosive devices were found at the Shelby County Regional Forensic Center, which houses the morgue and Medical Examiner’s Office that conducted Wiley’s autopsy. Dr. O.C, Smith, the medical examiner, told Memphis’ Commercial Appeal, “We have done several high-profile cases from Dr. Wiley to Katherine Smith (a Department of Motor Vehicles employee mysteriously found burned to death in her car after being charged in a federal probe with conspiracy to obtain fraudulent drivers’ licenses for men of Middle East origin) but there has been no indication that we offended anyone . . . we just don’t know if we were the attended target or not.”

Knowledgeable U.S. and foreign intelligence sources have revealed that Wiley may have been silenced as a result of his discovery of U.S. government work on biological warfare agents long after the U.S., along with the Soviet Union and Britain, signed the 1972 Biological Weapons Convention.

A South African Connection

The death of Wiley may be also linked to revelations recently uncovered in South Africa. His expertise on genetic fingerprints for various strains may have led him to particular countries and their bio-warfare projects.

The South African media has been abuzz with details of that nation’s former biological warfare program and its links to the CIA. The South African bio-chemical war program was code-named Project Coast and was centered at the Roodeplat Research Laboratories north of Pretoria. The lab maintained links to the US biowarfare facility at Fort and Britain’s Porton Down Laboratory. The head of the South African program, Dr. Wouter Basson, was reportedly offered a job with the CIA in the United States after the fall of the apartheid regime. According to former South African National Intelligence Agency deputy director Michael Kennedy, when Basson refused the offer, the CIA allegedly threatened to kill him. Nevertheless, the U.S. pressured the new President Nelson Mandela to turn over the records and fruits of Basson’s work. Much of this work was reportedly transported to Fort Detrick.

Basson also claimed to have been involved in a project called Operation Banana, which, using El Paso, Texas as a base with the CIA’s blessing, was designed to transport cocaine to South Africa from Peru. The cocaine, hidden in bananas, was to be used in developing a new incapacitating drug.

One of the South African’s secret projects involved sending anthrax through the mail. Among the techniques that fell into the hands of the Americans was a method by which anthrax spores were, with deadly effect, incorporated on to the gummed flaps of envelopes.

Other South African bio-chemical weapons allegedly transferred to the CIA included, in addition to anthrax, cholera, smallpox, salmonella, botulinum, tularemia, thallium, E.coli, racin, organophosphates, necrotising fasciitis, hepatitis A, HIV, paratyphoid, Sarin VX nerve gas, Ebola, Marburg, Rift Valley hemorrhagic fever viruses, Dengue fever, West Nile virus, highly potent CR tear gas, hallucinogens Ecstasy, Mandrax, BZ, and cocaine, anti-coagulant drugs, the deadly lethal injection drugs Scoline and Tubarine, and cyanide.

Many of Dr. Wiley’s family and friends doubt he would have committed suicide. The fact that he was certainly in a position to know about the origination of various viruses and bacteria — which could have led to the U.S. government — would have made him a prime target for a government seeking to cover up its illegal work in biological warfare.

Wiley’s Anthrax Research

And Wiley had a significant connection to anthrax research. Wiley was not only a professor at Harvard but also conducted research at the Chevy Chase, Maryland Howard Hughes Medical Center, which does work for the National Institutes of Health. On October 1, 2001, just three days before the first reported anthrax case in Florida, the Hughes Center announced that a joint Harvard-Hughes team had identified a mouse gene that made mice resistant to anthrax bacteria. Although the media failed to play it up later, that research involved using Wiley’s expertise on the immune system. The new gene, identified as Kif1C, located in chromosome 11 of a mouse, enhanced the defense systems of special immune cells, called macrophages, against the destructive effects of anthrax bacteria.

Wiley’s was not the only suspicious death of a scientist with knowledge of biological defenses. Just three day before Wiley’s death, Dr. Benito Que, a Miami Medical School cellular biologist specializing in infectious diseases, died in a violent attack. The Miami Herald reported Que died after “four men armed with a baseball bat attacked him at his car.” A week after Wiley died, Dr. Vladimir Pasechnik, a former scientist for Biopreparat, the Soviet Union’s biological weapons production factory, was found dead from an alleged stroke in Wiltshire, not far from Britain’s Porton Down biological warfare center. Pasechnik had defected from the Soviet Union in 1989 and was an expert on the Soviet Union’s anthrax, smallpox, plague, and tularemia programs. While at Biopreparat, Pasechnik worked for Alibek, who defected three years later. When he died, Pasechnik was assisting the British government’s efforts in providing bio-defenses against anthrax.

Anthrax and Operation Northwoods

For those who disbelieve the possibility that the U.S. Government is the number one suspect in the anthrax attacks, they are directed to James Bamford’s book on the National Security Agency, Body of Secrets. The book reveals that in 1962,Chairman of the Joint Chiefs of Staff Lyman Lemnitzer was planning, along with other member of the Joint Chiefs, a virtual coup d’etat against the administration of President Kennedy using acts of terrorism carried out by the military but to be blamed on the Castro government in Cuba. The secret pan, code-named Operation Northwoods, entailed having U.S. military personnel shoot innocent people on the streets of American cities, sink boats carrying Cuban refugees to Florida, and conduct terrorist bombings in Washington, DC, Miami and other cities. Innocent people were to be framed for committing bombings and hijacking planes. If John Glenn’s liftoff from Cape Canaveral in February 1962 were to end in an explosion, Castro would be blamed. Plans were made to shoot down civilian aircraft en route from the United States to Jamaica, Guatemala, Panama, or Venezuela and then blame Cuba. The U.S. military also planned to attack Jamaica and Trinidad and Tobago, both British colonies, and make it appear that the Cubans had done it in order to bring Britain into a war with Cuba.

So far, the Bush administration has refused to support a full and independent Congressional investigation into the events of September 11 and the later events involving anthrax. It seems it and the three-letter agencies the administration is so fond of praising, and funding, know more about the source of the anthrax attacks than they are admitting. If the saying, “where there’s smoke, there’s fire,” has any basis of truth, the United States is in the midst of a raging inferno. Who will answer the fire alarm?

Wayne Madsen is an investigative journalist based in Washington, DC. He can be reached at: WMadsen777@aol.commailto:WMadsen777@aol.com

First they went for the Muslims, Then they came for the Students. Fight the power

September 20, 2007

By Paul Craig Roberts

09/18/07 “ICH” — — Naïve Americans who think they live in a free society should watch this video filmed by students at a John Kerry speech September 17, Constitution Day, at the University of Florida in Gainesville.

At the conclusion of Kerry’s speech, Andrew Meyer, a 21-year old journalism student was selected by Senator Kerry to ask a question. Meyer held up a copy of BBC investigative reporter Greg Palast’s book, Armed Madhouse, and asked if Kerry was aware that Palast’s investigations determined that Kerry had actually won the election. Why, Meyer asked, had Kerry conceded the election so quickly when there were so many obvious examples of vote fraud? Why, Meyer, went on to ask, was Kerry refusing to consider Bush’s impeachment when Bush was about to initiate another act of military aggression, this time against Iran?

At this point the public’s protectors—the police—decided that Meyer had said too much. They grabbed Meyer and began dragging him off. Meyer said repeatedly, “I have done nothing wrong,” which under our laws he had not. He threatened no one and assaulted no one.

But the police decided that Meyer, an American citizen, had no right to free speech and no constitutional protection. They threw him to the floor and tasered him right in front of Senator Kerry and the large student audience, who captured on video the unquestionable act of police brutality. Meyer was carted off and jailed on a phony charge of “disrupting a public event.”

The question we should all ask is why did a United States Senator just stand there while Gestapo goons violated the constitutional rights of a student participating in a public event, brutalized him in full view of everyone, and then took him off to jail on phony charges?

Kerry’s meekness not only in the face of electoral fraud, not only in the face of Bush’s wars that are crimes under the Nuremberg standard, but also in the face of police goons trampling the constitutional rights of American citizens makes it completely clear that he was not fit to be president, and he is not fit to be a US senator.

Usually when police violate constitutional rights and commit acts of police brutality they do it when they believe no one is watching, not in front of a large audience. Clearly, the police have become more audacious in their abuse of rights and citizens. What explains the new fearlessness of police to violate rights and brutalize citizens without cause?

The answer is that police, most of whom have authoritarian personalities, have seen that constitutional rights are no longer protected. President Bush does not protect our constitutional rights. Neither does Vice President Cheney, nor the Attorney General, nor the US Congress. Just as Kerry allowed Meyer’s rights to be tasered out of him, Congress has enabled Bush to strip people, including American citizens, of constitutional protection and incarcerate them without presenting evidence.

How long before Kerry himself or some other senator will be dragged from his podium and tasered?

The Bush Republicans with complicit Democrats have essentially brought government accountability to an end in the US. The US government has 80,000 people, including ordinary American citizens, on its “no-fly list.” No one knows why they are on the list, and no one on the list can find out how to get off it. An unaccountable act by the Bush administration put them there.

Airport Security harasses and abuses people who do not fit any known definition of terrorist. Nalini Ghuman, a British-born citizen and music professor at Mills College in California was met on her return from a trip to England by armed guards at the airplane door and escorted away. A Gestapo goon squad tore up her US visa, defaced her British passport, body searched her, and told her she could leave immediately for England or be sent to a detention center.

Professor Ghuman, an Oxford University graduate with a Ph.D. from the University of California at Berkeley, says she feels like the character in Kafka’s book, The Trial. “I don’t know why it’s happened, what I’m accused of. There’s no opportunity to defend myself. One is just completely powerless.” Over one year later there is still no answer.

The Bush Republicans and their Democratic toadies have, in the name of “security,” made all of us powerless. While Senator John Kerry and his Democratic colleagues stand silently, the Bush administration has stolen our country from us and turned us into subjects.

Paul Craig Roberts was Assistant Secretary of the Treasury in the Reagan Administration. He is the author of Supply-Side Revolution: An Insider’s Account of Policymaking in Washington; Alienation and the Soviet Economy and Meltdown: Inside the Soviet Economy, and is the co-author with Lawrence M. Stratton of The Tyranny of Good Intentions: How Prosecutors and Bureaucrats Are Trampling the Constitution in the Name of Justice.

Mind Compartmentalization

September 16, 2007

Various perspectives on compartmentalization help to better understand it. In Pete Seeger’s song, “Little Boxes,” the lyrics read, in part: “And the people in the houses, All go to the university, And they all get put in boxes, Little boxes all the same. And there’s doctors, and there’s lawyers, And business executives, And they’re all made outta ticky-tacky, And they all look just the same.”

A Google search on “Mind Compartmentalization” yielded these quotes:

- This system will not be a gigantic superorganism, despite the implied high degree of structural integration. The global “mind” will be compartmentalized, with many relatively independent components and threads, separated from each other by subject boundaries, as well as property, privacy, and security-related interests.

- The whole of civilization rests on the male’s ability to compartmentalize his mind. Compartmentalization allows the male to suppress and contain potentially disruptive things.

- The premise of government/occult based mind control is to compartmentalize the brain, and then use techniques to access the different sections of the brain while the subject is hypnotized.

The last quote, dealing with mind control and compartmentalization, is reportedly echoed in Naomi Klein’s latest book, “The Shock Doctrine: The Rise Of Disaster Capitalism.” According to a book review in Britain’s Guardian newspaper, “Klein begins her first chapter with a moving account of a conversation she had with a victim of a covert programme of mind-control experiments, carried out in Canada in the 1950s, which used people suffering from minor psychiatric ailments to try out techniques of ‘de-patterning’ that aimed to scramble and reshape their personalities.” (“Naomi Klein’s critique of neo-liberalism, The Shock Doctrine, is both timely and devastating,” by John Gray. The Guardian, September 15, 2007. http://books.guardian.co.uk/review/story/0,,2169201,00.html)

http://books.guardian.co.uk/shockdoctrine/0,,2159184,00.html

Whistleblowers on Fraud Facing Penalties

September 14, 2007

Whistleblowers on Fraud Facing Penalties

By DEBORAH HASTINGS 08.24.07, 3:16 PM ET

One after another, the men and women who have stepped forward to report corruption in the massive effort to rebuild Iraq have been vilified, fired and demoted.

Or worse.

For daring to report illegal arms sales, Navy veteran Donald Vance says he was imprisoned by the American military in a security compound outside Baghdad and subjected to harsh interrogation methods.

There were times, huddled on the floor in solitary confinement with that head-banging music blaring dawn to dusk and interrogators yelling the same questions over and over, that Vance began to wish he had just kept his mouth shut.

He had thought he was doing a good and noble thing when he started telling the FBI about the guns and the land mines and the rocket-launchers – all of them being sold for cash, no receipts necessary, he said. He told a federal agent the buyers were Iraqi insurgents, American soldiers, State Department workers, and Iraqi embassy and ministry employees.

The seller, he claimed, was the Iraqi-owned company he worked for, Shield Group Security Co.

“It was a Wal-Mart (nyse: WMT – news – people ) for guns,” he says. “It was all illegal and everyone knew it.”

So Vance says he blew the whistle, supplying photos and documents and other intelligence to an FBI agent in his hometown of Chicago because he didn’t know whom to trust in Iraq.

For his trouble, he says, he got 97 days in Camp Cropper, an American military prison outside Baghdad that once held Saddam Hussein, and he was classified a security detainee.

Also held was colleague Nathan Ertel, who helped Vance gather evidence documenting the sales, according to a federal lawsuit both have filed in Chicago, alleging they were illegally imprisoned and subjected to physical and mental interrogation tactics “reserved for terrorists and so-called enemy combatants.”

Corruption has long plagued Iraq reconstruction. Hundreds of projects may never be finished, including repairs to the country’s oil pipelines and electricity system. Congress gave more than $30 billion to rebuild Iraq, and at least $8.8 billion of it has disappeared, according to a government reconstruction audit.

Despite this staggering mess, there are no noble outcomes for those who have blown the whistle, according to a review of such cases by The Associated Press.

“If you do it, you will be destroyed,” said William Weaver, professor of political science at the University of Texas-El Paso and senior advisor to the National Security Whistleblowers Coalition.

“Reconstruction is so rife with corruption. Sometimes people ask me, `Should I do this?’ And my answer is no. If they’re married, they’ll lose their family. They will lose their jobs. They will lose everything,” Weaver said.

They have been fired or demoted, shunned by colleagues, and denied government support in whistleblower lawsuits filed against contracting firms.

“The only way we can find out what is going on is for someone to come forward and let us know,” said Beth Daley of the Project on Government Oversight, an independent, nonprofit group that investigates corruption. “But when they do, the weight of the government comes down on them. The message is, ‘Don’t blow the whistle or we’ll make your life hell.’

“It’s heartbreaking,” Daley said. “There is an even greater need for whistleblowers now. But they are made into public martyrs. It’s a disgrace. Their lives get ruined.”

Bunnatine “Bunny” Greenhouse knows this only too well. As the highest-ranking civilian contracting officer in the U.S. Army Corps of Engineers, she testified before a congressional committee in 2005 that she found widespread fraud in multibillion-dollar rebuilding contracts awarded to former Halliburton (nyse: HAL – news – people ) subsidiary KBR (nyse: KBR – news – people ).

Soon after, Greenhouse was demoted. She now sits in a tiny cubicle in a different department with very little to do and no decision-making authority, at the end of an otherwise exemplary 20-year career.

People she has known for years no longer speak to her.

“It’s just amazing how we say we want to remove fraud from our government, then we gag people who are just trying to stand up and do the right thing,” she says.

In her demotion, her supervisors said she was performing poorly. “They just wanted to get rid of me,” she says softly. The Army Corps of Engineers denies her claims.

“You just don’t have happy endings,” said Weaver. “She was a wonderful example of a federal employee. They just completely creamed her. In the end, no one followed up, no one cared.”

But Greenhouse regrets nothing. “I have the courage to say what needs to be said. I paid the price,” she says.

Then there is Robert Isakson, who filed a whistleblower suit against contractor Custer Battles in 2004, alleging the company – with which he was briefly associated – bilked the U.S. government out of tens of millions of dollars by filing fake invoices and padding other bills for reconstruction work.

He and his co-plaintiff, William Baldwin, a former employee fired by the firm, doggedly pursued the suit for two years, gathering evidence on their own and flying overseas to obtain more information from witnesses. Eventually, a federal jury agreed with them and awarded a $10 million judgment against the now-defunct firm, which had denied all wrongdoing.

It was the first civil verdict for Iraq reconstruction fraud.

But in 2006, U.S. District Judge T.S. Ellis III overturned the jury award. He said Isakson and Baldwin failed to prove that the Coalition Provisional Authority, the U.S.-backed occupier of Iraq for 14 months, was part of the U.S. government.

Not a single Iraq whistleblower suit has gone to trial since.

“It’s a sad, heartbreaking comment on the system,” said Isakson, a former FBI agent who owns an international contracting company based in Alabama. “I tried to help the government, and the government didn’t seem to care.”

One way to blow the whistle is to file a “qui tam” lawsuit (taken from the Latin phrase “he who sues for the king, as well as for himself”) under the federal False Claims Act.

Signed by Abraham Lincoln in response to military contractors selling defective products to the Union Army, the act allows private citizens to sue on the government’s behalf.

The government has the option to sign on, with all plaintiffs receiving a percentage of monetary damages, which are tripled in these suits.

It can be a straightforward and effective way to recoup federal funds lost to fraud. In the past, the Justice Department has joined several such cases and won. They included instances of Medicare and Medicaid overbilling, and padded invoices from domestic contractors.

But the government has not joined a single quit tam suit alleging Iraq reconstruction abuse, estimated in the tens of millions. At least a dozen have been filed since 2004.

“It taints these cases,” said attorney Alan Grayson, who filed the Custer Battles suit and several others like it. “If the government won’t sign on, then it can’t be a very good case – that’s the effect it has on judges.”

The Justice Department declined comment.

Most of the lawsuits are brought by former employees of giant firms. Some plaintiffs have testified before members of Congress, providing examples of fraud they say they witnessed and the retaliation they experienced after speaking up.

Julie McBride testified last year that as a “morale, welfare and recreation coordinator” at Camp Fallujah, she saw KBR exaggerate costs by double- and triple-counting the number of soldiers who used recreational facilities.

She also said the company took supplies destined for a Super Bowl party for U.S. troops and instead used them to stage a celebration for themselves.

“After I voiced my concerns about what I believed to be accounting fraud, Halliburton placed me under guard and kept me in seclusion,” she told the committee. “My property was searched, and I was specifically told that I was not allowed to speak to any member of the U.S. military. I remained under guard until I was flown out of the country.”

Halliburton and KBR denied her testimony.

She also has filed a whistleblower suit. The Justice Department has said it would not join the action. But last month, a federal judge refused a motion by KBR to dismiss the lawsuit.

Donald Vance, the contractor and Navy veteran detained in Iraq after he blew the whistle on his company’s weapons sales, says he has stopped talking to the federal government.

Navy Capt. John Fleming, a spokesman for U.S. detention operations in Iraq, confirmed the detentions but said he could provide no further details because of the lawsuit.

According to their suit, Vance and Ertel gathered photographs and documents, which Vance fed to Chicago FBI agent Travis Carlisle for six months beginning in October 2005. Carlisle, reached by phone at Chicago’s FBI field office, declined comment. An agency spokesman also would not comment.

The Iraqi company has since disbanded, according the suit.

Vance said things went terribly wrong in April 2006, when he and Ertel were stripped of their security passes and confined to the company compound.

Panicking, Vance said, he called the U.S. Embassy in Baghdad, where hostage experts got on the phone and told him “you’re about to be kidnapped. Lock yourself in a room with all the weapons you can get your hands on.'”

The military sent a Special Forces team to rescue them, Vance said, and the two men showed the soldiers where the weapons caches were stored. At the embassy, the men were debriefed and allowed to sleep for a few hours. “I thought I was among friends,” Vance said.

The men said they were cuffed and hooded and driven to Camp Cropper, where Vance was held for nearly three months and his colleague for a little more than a month. Eventually, their jailers said they were being held as security internees because their employer was suspected of selling weapons to terrorists and insurgents, the lawsuit said.

The prisoners said they repeatedly told interrogators to contact Carlisle in Chicago. “One set of interrogators told us that Travis Carlisle doesn’t exist. Then some others would say, ‘He says he doesn’t know who you are,'” Vance said.

Released first was Ertel, who has returned to work in Iraq for a different company. Vance said he has never learned why he was held longer. His own interrogations, he said, seemed focused on why he reported his information to someone outside Iraq.

And then one day, without explanation, he was released.

“They drove me to Baghdad International Airport and dumped me,” he said.

When he got home, he decided to never call the FBI again. He called a lawyer, instead.

“There’s an unspoken rule in Baghdad,” he said. “Don’t snitch on people and don’t burn bridges.”

For doing both, Vance said, he paid with 97 days of his life.

Copyright 2007 Associated Press. All rights reserved. This material may not be published broadcast, rewritten, or redistributed

Are The Banks In Trouble?

September 9, 2007

by Mike Whitney

“The new capitalist gods must love the poor – they are making so many more of them.” Bill Bonner, “The Daily Reckoning”

“The hope of every central bank is that the real problem can be kept from public view. The truth is that the public—even professionals on Wall Street—have no clue what the real problem is. They know it has something to do with derivatives, but none of them realize that it’s more than a $20 trillion mountain of unfunded, unregulated paper that has just been discovered to not have a market and, therefore, no real value… When the dollar realizes the seriousness of the situation—be that now or sometime soon—the bottom will drop out.” Jim Sinclair, Investment analyst

About a month ago, I wrote an article “Stock Market Brushfire: Will there be a run on the banks?” which showed how the collapse in the housing market and the deterioration in mortgage-backed bonds (CDOs) in the secondary market was creating difficulties for the banking system. Now these problems are becoming more apparent.

From the Wall Street Journal:

“The rising interbank lending rates are a proxy of sorts for the increased risk that some banks, somewhere, may go belly up.” (Editorial; WSJ, 9-6-07)

Ironically, the WSJ editorial staff—-which normally defends deregulation and laissez faire economics “tooth-n-nail”—is now calling for regulators to make sure they are “on top of the banks they are supposed to be regulating, so we don’t get any surprise bank failures that spook the markets and confirm the worst fears being whispered about.”

“Surprise bank failures?”

Henry Liu sums it up like this in his article, “The Rise of the non-bank system”—required reading for anyone who wants to understand why a stock market crash is imminent:

“Banks worldwide now reportedly face risk exposure of US$891 billion in asset-backed commercial paper facilities (ABCP) due to callable bank credit agreements with borrowers designed to ensure ABCP investors are paid back when the short-term debt matures, even if banks cannot sell new ABCP on behalf of the issuing companies to roll over the matured debt because the market views the assets behind the paper as of uncertain market value.

This signifies that the crisis is no longer one of liquidity, but of deteriorating creditworthiness systemwide that restoring liquidity alone cannot cure. The liquidity crunch is a symptom, not the disease. The disease is a decade of permissive tolerance for credit abuse in which the banks, regulators and rating agencies were willing accomplices.” (Henry Liu,”The Rise of the Non-bank System”, Asia Times)

That’s right; nearly $1 trillion in worthless asset-backed paper is clogging the system putting the kybosh on the big private equity deals and spreading panic through the money markets. It’s a slow-motion train wreck and there’s not a thing the Fed can do about it.

This isn’t a liquidity problem that can be fixed by lowering the Fed’s fund rate and creating more easy credit. This is a solvency crisis; the underlying assets upon which this world of “structured finance” is built have no established market value, therefore—as Jim Sinclair suggests—they’re worthless. That means that the trillions of dollars which have been leveraged against these shaky assets—in the form of credit default swaps (CDSs) and numerous other bizarre-sounding derivatives—will begin to cascade down wiping out trillions in market value.

How serious is it? Economist Liu puts it like this:

“Even if the Fed bails out the banks by easing bank reserve and capital requirements to absorb that massive amount, the raging forest fire in the non-bank financial system will still present finance capitalism with its greatest test in eight decades.”

OVERVIEW

Credit standards are tightening and banks are increasingly reluctant to loan money to each other not knowing who may be sitting on billions of dollars in toxic mortgage-backed debt. (Collateralized debt obligations) It makes no difference that the “underlying economy is sound” as Bernanke likes to say. When banks hesitate to loan money to each other; it shows that there is real uncertainty about the solvency of the other banks. It slows down commerce and the gears on the economic machine begin to rust in place.

The banks woes have been exacerbated by the flight of investors from money market funds, many of which are backed by Mortgage-backed Securities (MBS). Wary investors are running for the safety of US Treasuries even though yields that have declined at a record pace. This is causing problems in the Commercial Paper market as well as for the lesser-know SIVs and “conduits”. These abstruse-sounding investment vehicles are the essential plumbing that maintains normalcy in the markets. Commercial paper is a $2.2 trillion market. When it shrinks by more than $200 billion —as it has in the last 3 weeks–the effects can be felt through the entire system.

The credit crunch has spread across the whole gamut of commercial paper and low-grade debt. Banks are hoarding cash and refusing loans to even credit-worthy applicants. The collapse in subprime loans is just part of the story. More than 50% of all mortgages in the last two years have been unconventional loans—no down payment, no verification of income “no doc”, interest-only, negative amortization, piggyback, 2-28s, teaser rates, adjustable rate mortgages “ARMs”. All of these reflect the shoddy lending standards of the past few years and all are contributing to the unprecedented rate of defaults. Now the banks are holding $300 billion of these “unmarketable” mortgage-backed CDOs and another $200 billion in equally-suspect CLOs. (Collateralized loan obligations; the CDOs corporate-twin).

Even more worrisome, the large investment banks have myriad “off-book” operations which are in distress. This has forced the banks to circle the wagons and reduce their issuance of loans which is accelerating the downturn in housing. Typically, housing bubbles unwind very slowly over a 5 to 10 year period. That won’t be the case this time. The surge in inventory, the financial distress of many homeowners and the complete breakdown in loan-origination (due to the growing credit crunch) ensures that the housing market will crash-land sometime in late 2008 or early 2009. The banks are expected to write-off a considerable portion of their CDO-debt at the end of the 3rd Quarter rather than keep the losses on their books. This will further hasten the decline in housing prices.

The banks are also suffering from the sudden sluggishness in leveraged buyouts (LBOs). Credit problems have slowed private equity deals to a dribble. In July there were $579 billion in LBOs. In August that number shrunk to a paltry $222 billion. By September those figures will deteriorate to double-digits. The big deals aren’t getting done and debt is not rolling over. More than $1 trillion in debt will have to be refinanced in the next 5 weeks. In the present climate, that doesn’t look likely. Something’s has got to give. The market has frozen and the Fed’s $60 billion repo-lifeline has done nothing to help.

In the first 7 months of 2007, LBOs accounted for “$37 of every $100 spent on deals in the US”.

37%! How will the financial giants make up for the windfall profits that these deals generated?

Answer: They won’t. Just as they won’t make up for the enormous origination fees they made from “securitizing” mortgages and selling them off to credulous pension funds, insurance companies and foreign banks.

As Steven Rattner of DLJ Merchant Banking said, “It’s become nearly impossible to finance a private equity transaction of over $1 billion.” (WSJ) The Golden Era of Acquisitions and Mega-mergers is coming to an end. We can expect that the financial giants will probably follow the same trajectory as the Dot.coms following the 2001 NASDAQ-rout.

The investment banks are also facing enormous potential losses from liabilities that “operate off their balance sheets” In David Reilly’s article “Conduit Risks are hovering over Citigroup” (WSJ 9-5-07) Reilly points out that “banks such as Citigroup Inc. could find themselves burdened by affiliated investment vehicles that issue tens of billions of dollars in short-term debt known as commercial paper”… Citigroup, for example, owns about 25% of the market for SIVs, representing nearly $100 billion of assets under management. The largest Citigroup SIV is Centauri Corp., which had $21 billion in outstanding debt as of February 2007, according to a Citigroup research report. There is NO MENTION OF CENTAURI IN ITS 2006 ANNUAL FILING with the Securities and Exchange Commission.

Yet some investors worry that if vehicles such as Centauri stumble, either failing to sell commercial paper or suffering severe losses in the assets it holds, Citibank could wind up having to help by lending funds to keep the vehicle operating or even taking on some losses”.

So, many investors don’t know that Citigroup could be holding the bag for “$21 billion in outstanding debt”? Or, perhaps, the entire $100 billion is red ink; who knows? (Citigroup’s stock dropped by more than 2% after this report appeared in the WSJ.)

Another report which appeared in CNN Money further adds to the suspicion that the banks’ “brokerage affiliates” may be in trouble:

“The Aug. 20 letters from the Fed to Citigroup and Bank of America state that the Fed, which regulates large parts of the U.S. financial system, has agreed to exempt both banks from rules that effectively limit the amount of lending that their federally-insured banks can do with their brokerage affiliates. The exemption, which is temporary, means, for example, that Citigroup’s Citibank entity can substantially increase funding to Citigroup Global Markets, its brokerage subsidiary. Citigroup and Bank of America requested the exemptions, according to the letters, to provide liquidity to those holding mortgage loans, mortgage-backed securities, and other securities…This unusual move by the Fed shows that the largest Wall Street firms are continuing to have problems funding operations during the current market difficulties.” (CNN Money)

Does this mean that the other large banks are involved in the same type of “hide-n-seek” strategies? Sounds a lot like Enron’s “off-the-books” shenanigans, doesn’t it?

Wall Street Journal:

“Any off-balance-sheet issues are traditionally POORLY DISCLOSED, so to some extent, you’re dependent on the insight that management is willing to provide you and that, frankly, is very limited,” says Mark Fitzgibbon, director of research at Sandler O’Neill & Partners.”…..Accounting rules DON’T REQUIRE BANKS TO SEPARATELY RECORD ANYTHING RELATED TO THE RISK that they will have to loan the entities money to keep them functioning during a markets crisis.”….” The vehicles (SIVs and conduits) ARE OFTEN ESTABLISHED IN A TAX HAVEN AND ARE RUN SOLEY FOR INVESTMENT PURPOSES AS OPPOSED TO TYPICAL CORPORATE ACTIVITIES.”

Still think the banks are on solid ground?

“Citigroup, the nation’s largest bank as measured by market value and assets. Its latest financial results showed that it administers off-balance-sheet, conduit vehicles used to issue commercial paper that have assets of about $77 BILLION.

Citigroup is also affiliated with structured investment vehicles, or SIVs that have “nearly $100 billion” in assets, according to a letter Citigroup wrote to some investors in these vehicles last month.” (IBID)

Yes; and how many of these “assets” are in fact cooperate debt, auto loans, credit card debt, and student loans that have been securitized and are now under extreme pressure in a slumping market?

In an “up market” loans can provide a valuable income-stream that that transforms someone else’s debt into a valuable asset. In a down-market, however, defaults can wipe out trillions in market capitalization overnight.

HOW DID WE GET INTO THIS MESS?

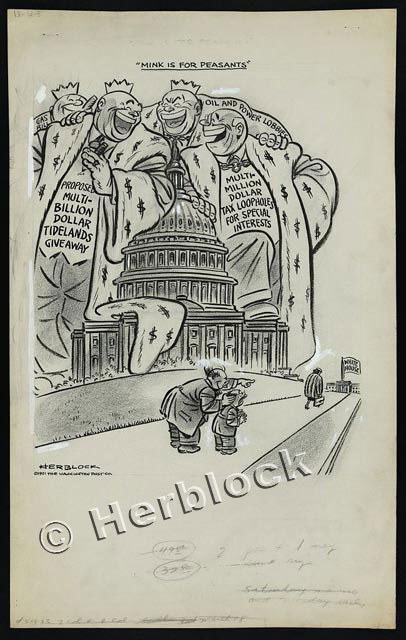

More than 20 years of dogged lobbying from the financial industry paid off with the repeal of the Glass-Steagall Act which was passed by Congress following the 1929 stock market crash. The bill was written to limit the conflicts of interest when commercial banks are permitted to underwrite stocks or bonds.

The financial industry whittled away at Glass-Steagall for years before finally breaking down its regulatory restrictions in August 1987, Alan Greenspan — formerly a director of J.P. Morgan and a proponent of banking deregulation — became chairman of the Federal Reserve Board.

“In 1990, J.P. Morgan became the first bank to receive permission from the Federal Reserve to underwrite securities, so long as its underwriting business does not exceed the 10 percent limit. In December 1996, with the support of Chairman Alan Greenspan, the Federal Reserve Board issues a precedent-shattering decision permitting bank holding companies to own investment bank affiliates with up to 25 percent of their business in securities underwriting (up from 10 percent).

This expansion of the loophole created by the Fed’s 1987 reinterpretation of Section 20 of Glass-Steagall effectively rendered Glass-Steagall obsolete.” (“The Long Demise of Glass Steagall, Frontline, PBS)

In 1999, after 25 years and $300 million of lobbying efforts, Congress aided by President Bill Clinton, finally repealed Glass-Steagall. This paved the way for the problems we are now facing.

Another contributing factor to the current banking-muddle is the Basel rules. According to the BIS (Bank of International Settlements) website:

“The Basel Committee on Banking Supervision provides a forum for regular cooperation on banking supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. It seeks to do so by exchanging information on national supervisory issues, approaches and techniques, with a view to promoting common understanding. At times, the Committee uses this common understanding to develop guidelines and supervisory standards in areas where they are considered desirable. In this regard, the Committee is best known for its international standards on capital adequacy; the Core Principles for Effective Banking Supervision; and the Concordat on cross-border banking supervision.”

The Basel Committee on Banking (Basel 2) requires “banks to boost the capital they hold in reserve against the loans on their books.”

Sounds like a good thing, doesn’t it? This protects the overall financial system as well as the individual depositor. Unfortunately, the banks found a way to circumvent the rules for minimum reserves by “securitizing” pools of mortgages (MBS) rather than holding individual mortgages. (which called for more reserves) This provided lavish origination and distribution fees for banks, but shifted much of the risk of default to Wall Street investors. Now, the banks are saddled with roughly $300 billion in mortgage-backed debt (CDOs) that no one wants and it is uncertain whether they have sufficient reserves to cover their losses.

By October, we should know how this will all play out. As David Wessel points out in “New Bank Capital requirements helped to Spread Credit Woes”:

“Banks now behave more like securities firms, more likely to mark down the value of assets when market prices fall—even to distressed levels—rather than sitting on bad loans for a decade and pretending they’ll be paid back.”

The downside of this is that once that banks write off these toxic MBSs and CDOs; the hedge funds, insurance companies and pension funds will be forced to do the same—-dumping boatloads of this bond-sludge on the market driving down prices and triggering a panic-sell-off. This is what the Fed is trying to prevent through its $60 billion repo-bailout.

Regrettably, the Fed cannot hope to remove half-trillion of bad debt from the balance sheets of the banks or forestall the collapse of related financial institutions and funds which are loaded with these “unmarketable” time-bombs. Besides, most of the mortgage derivatives (CDOs) have been massively enhanced with low interest leverage from the “carry trade”. When the value of these CDOs is finally determined—which we expect will happen sometime before the end of the 3rd Quarter—we can expect the stock market to fall sharply and the housing recession to turn into a full-blown economic crisis.

ALAN GREENSPAN: THE FIFTH HORSEMAN?

So, who’s to blame? The finger-pointing has already begun and more and more people are beginning to see how this massive economy-busting equity bubble originated at the Federal Reserve— it is the logical corollary of former Fed-chief Alan Greenspan’s “easy money” policies.

Henry C K Liu sums up Greenspan’s tenure at the Fed in his article “Why the Subprime Bust will Spread”:

“Greenspan presided over the greatest expansion of speculative finance in history, including a trillion-dollar hedge-fund industry, bloated Wall Street-firm balance sheets approaching $2 trillion, a $3.3 trillion repo (repurchase agreement) market, and a global derivatives market with notional values surpassing an unfathomable $220 trillion.

On Greenspan’s 18-year watch, assets of US government-sponsored enterprises (GSEs) ballooned 830%, from $346 billion to $2.872 trillion. GSEs are financing entities created by the US Congress to fund subsidized loans to certain groups of borrowers such as middle- and low-income homeowners, farmers and students. Agency mortgage-backed securities (MBSs) surged 670% to $3.55 trillion. Outstanding asset-backed securities (ABSs) exploded from $75 billion to more than $2.7 trillion.”( Henry Liu, “Why the Subprime Bust will Spread”, Asia Times)

“The greatest expansion of speculative finance in history”. That says it all.

But no one makes the case against Greenspan better than Greenspan himself. Here are some of his comments at the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Washington, D.C. April 8, 2005. They show that Greenspan “rubber stamped” every one of the policies which have since metastasized and spread through the entire US economy.

Greenspan: Champion of Subprime loans:

“Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country. With these advance in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers.”

Greenspan: Main Proponent of Toxic CDOs

“The development of a broad-based secondary market for mortgage loans also greatly expanded consumer access to credit. By reducing the risk of making long-term, fixed-rate loans and ensuring liquidity for mortgage lenders, the secondary market helped stimulate widespread competition in the mortgage business. The mortgage-backed security helped create a national and even an international market for mortgages, and market support for a wider variety of home mortgage loan products became commonplace. This led to securitization of a variety of other consumer loan products, such as auto and credit card loans.”

Greenspan: Supporter of Loans to People with Bad Credit

“Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately.

These improvements have led to the rapid growth in SUBPRIME mortgage lending…fostering constructive innovation that is both responsive to market demand and beneficial to consumers.”

“Improved access to credit for consumers, and especially these more-recent developments, has had significant benefits.